Your settlement spreadsheet is a malpractice claim waiting to happen.

SettleSheet replaces the Excel file you're afraid to touch. Built specifically for Personal Injury (PI) settlement calculations with the auditability of a database and the flexibility of a spreadsheet.

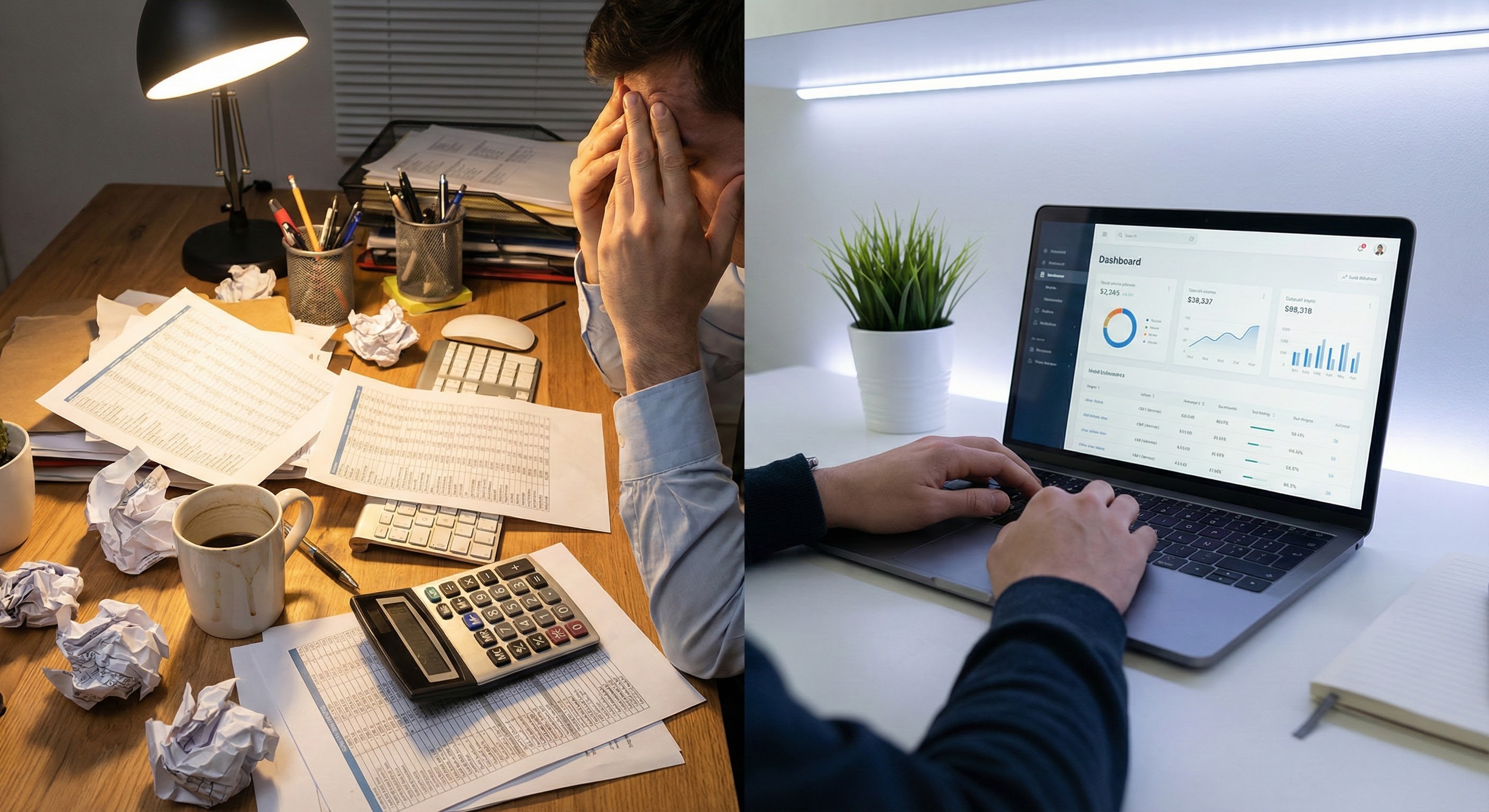

You know this workflow

One formula error. One trust accounting violation.

You've built the spreadsheet. The one with nested IF statements, lien priority formulas nobody's allowed to touch, and that one Medicare reduction calculation you copied from the last paralegal.

Medicare demands a final reduction? Update the formula. Client adds UIM coverage? Hope you catch all the fee calculation references. Lien negotiation changes mid-closing? Pray the client net recalculates correctly.

One wrong cell reference. That's all it takes.

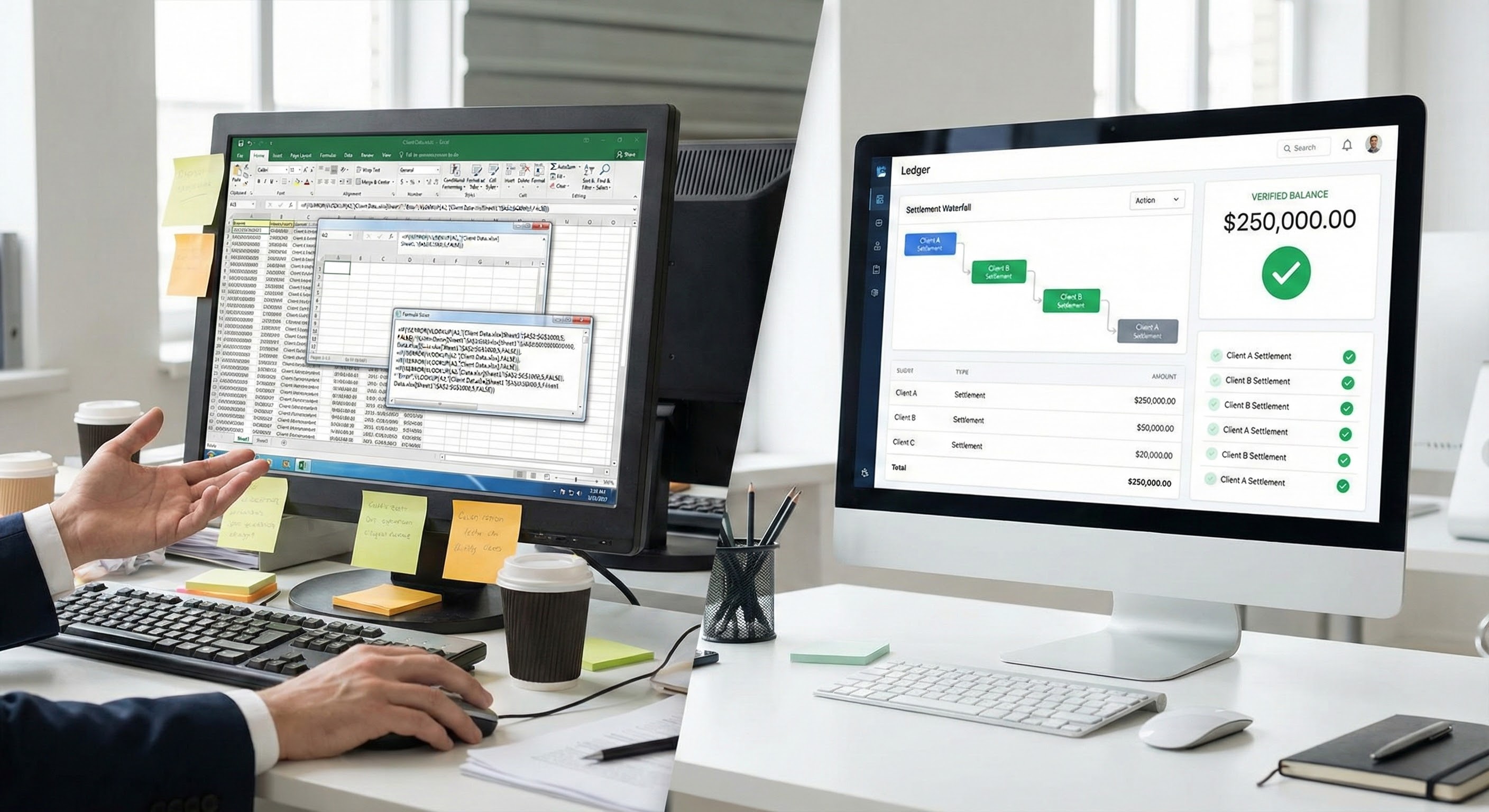

The Solution

SettleSheet replaces your settlement spreadsheet.

Not another case management system. Built from the ground up for PI settlement waterfall calculations.

- Conservation of value guaranteed.

- Every calculation automatically verifies: Gross = Fee + Costs + Liens + Holdback + Client Net. If it doesn't balance, you can't generate the PDF.

- Real-time waterfall recalculation.

- Change a lien negotiation amount? Client net updates instantly. No cell references to break. No formulas to audit.

- Multi-tranche fee calculation.

- Liability at 33.33%. MedPay exempt. UIM at reduced 25%. The system handles it automatically with proper fee breakdown.

- Referral fee automation.

- Handle complex co-counsel splits automatically. The system treats referral fees as a distribution of the attorney fee, not a generic "cost," keeping your logic clean.

- Medicare reduction calculator.

- Built-in 42 CFR § 411.37 procurement cost reduction. No more manual spreadsheet formulas for federal lien math.

- Catch unconfirmed liens.

- Generate final statement with unconfirmed Medicare demand? System blocks you with a warning. No more closing errors.

- Forensic audit trail.

- Every change is logged with a mandatory "Reason." If a client disputes the math three months later, you have a timestamped history of exactly who changed the lien amount and why.

How It Works

From gross recovery to client net in minutes

-

1Enter your settlement amounts

- Liability policy $75k. MedPay $5k. UIM $25k. Mark each tranche with its fee treatment: Standard, Reduced, or Exempt.

-

2Configure your fee structure

- Flat 33.33% or sliding scale tiered fees. Calculate on gross or net-of-costs. System handles both CA MICRA-style and standard contingency.

-

3Add costs and negotiate liens

- Track hard costs and soft costs. Negotiate each lien with real-time savings display. Set your priority order. Apply common fund reductions where applicable.

-

4Generate settlement statement

- One-click PDF with full breakdown, lien negotiation savings, and signature lines. Clean, client-ready document with verified math.

"Clio and MyCase are built for billable hours, not PI recoveries. We maintain fragile Excel files with no version control and no audit trail. One formula error is a trust accounting violation."

Built-in Safety Rails

Catch the violation before it becomes a bar complaint.

Minor settlements, fee caps, and unconfirmed liens aren't just warnings — they're professional liability traps. SettleSheet surfaces them before you generate the final statement.

Frequently asked questions

-

Does this replace Clio or MyCase?

-

No. SettleSheet works alongside your existing case management system. Clio and MyCase are built for time-and-billing (hours × rate). PI firms need ledger architecture (Recovery - Liens = Net). We handle settlement calculations; they handle case management.

-

Does SettleSheet enforce state-specific lien rules?

-

No. State lien priority rules vary wildly (50 states, plus county-level variations in Florida). Rather than become a compliance engine that creates liability, SettleSheet is a math engine with guardrails. You set the lien priority order based on your jurisdiction. The system executes the calculation accurately and maintains the audit trail. Optional state presets may come in v2.

-

What about sliding scale fee structures?

-

Fully supported. Configure tiered fees (NY/CA medical malpractice style): first $250k at 30%, next $250k at 25%, etc. System handles both flat percentage and multi-tier sliding scales, calculated on either gross or net-of-costs.

-

How does the audit trail work?

-

We maintain a complete revision history. Every time a number changes, the system logs who made the change, when, and—most importantly—requires them to note why. If a client disputes the math three months after closing, you have a timestamped history of exactly who changed the lien amount and why.

-

How much does it cost?

-

Early access is free while we build with our first customers. Launch pricing: $149/month (Solo), $349/month (Small Firm), $749/month (Firm). No implementation fees. No consultants. One prevented trust accounting violation pays for a decade of subscriptions.

Ready to retire the settlement spreadsheet?

We're onboarding a small group of Personal Injury paralegals and attorneys for early access. You'll shape the product. We'll solve your actual problems.

No credit card required. Limited spots available.